FinCEN Requires BOI Reporting in Breckenridge, TX – File by 01/01/2025 to Avoid Fines

The Corporate Transparency Act (CTA) mandates that Breckenridge, TX businesses disclose Beneficial Ownership Information (BOI) to FinCEN by January 1, 2025, to combat financial crimes like money laundering and tax evasion.

As of today, 11-26-2024, Breckenridge business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—don't delay, or you could face fines of $500 per day!

Action Steps for Breckenridge Businesses

1. Confirm Your Filing Requirements

Deadline: ASAP

Most LLCs, corporations, and similar entities must file unless exempt, such as banks, charities, or public companies.

2. Identify Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is anyone who:

-

Owns 25% or more of the company, or

-

Exercises substantial control over its decisions.

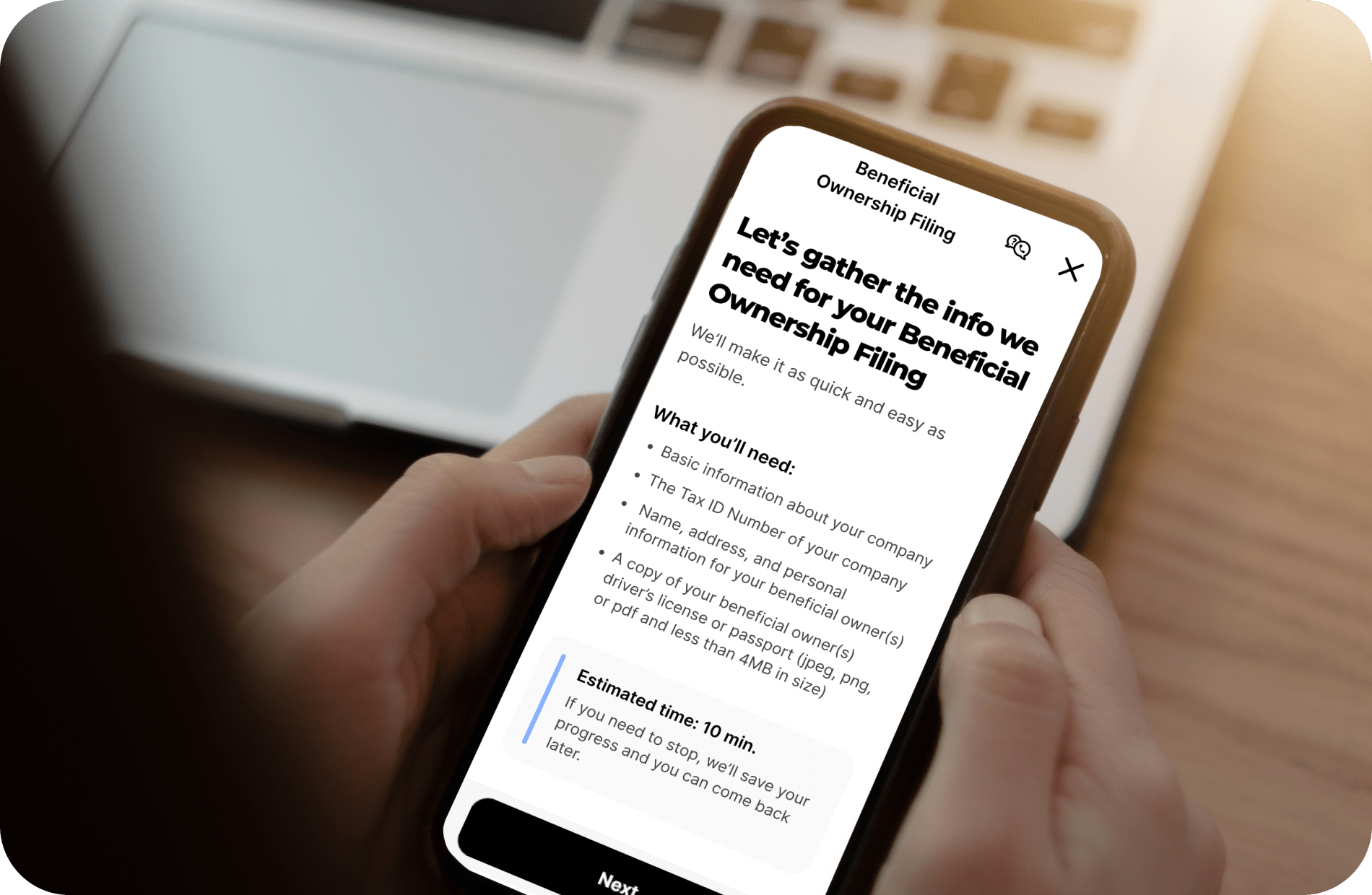

3. Prepare the Required Information

Deadline: 12-17-2024

Key details include:

-

Business Info: Name, EIN, and address.

-

Owner Info: Full name, address, birth date, and ID details (e.g., driver’s license or passport).

4. Submit Your BOI Report

Deadlines:

-

Existing companies: File by 01/01/2025.

-

New businesses (2024): File within 90 days of formation.

-

New businesses (2025): File within 30 days of formation.

ZenBusiness simplifies filing for small businesses—get started today.

Understanding BOI Reporting

Who Must File?

Most corporations and LLCs in Breckenridge are "reporting companies" under the CTA, except exempt businesses like nonprofits, publicly traded entities, and financial institutions. For example, a local Breckenridge landscaping LLC would need to file, while a regional credit union would not.

What is a Beneficial Owner?

A beneficial owner is defined as someone who:

-

Owns at least 25% of the company, or

-

Exercises control over business decisions.

Example: If a Breckenridge café has two co-owners, each owning 50%, both are considered beneficial owners and must be reported.

Required Information

BOI reports must include:

-

Company details: Legal name, EIN, and address.

-

Owner details: Full name, birthdate, residential address, and government ID information.

Filing Process and Deadlines

Reports are submitted electronically to FinCEN. Deadlines depend on the company’s formation date:

-

Existing companies: File by January 1, 2025.

-

New companies (2024): File within 90 days of formation.

-

New companies (2025): File within 30 days of formation.

Penalties for Non-Compliance

Non-compliance can lead to:

-

Fines up to $500 per day, totaling up to $10,000.

-

Imprisonment for providing false or incomplete information.

Businesses have a 90-day correction period to resolve errors without penalty.

ZenBusiness Can Help

ZenBusiness specializes in BOI reporting, offering reliable, efficient services to help you meet deadlines and avoid penalties. Learn more about how ZenBusiness can assist your filing needs.

Resources for Compliance

Take action now to ensure your Breckenridge business complies before the January 1, 2025, deadline!

This Hot Deal is promoted by Breckenridge Chamber of Commerce.